· Introduction ·

Is tax season approaching? Have you just opened your LLC? Did you just receive a larger payment than you anticipated? Or any other situation that might make you curious about what you’re going to do when taxes come?

Understanding the flexibility of LLC tax structures can be the difference between being a profitable company or not or generating enough to cover your needs and grow.

The LLC structure offers incredible flexibility, allowing you to tailor your tax strategy to best fit your business needs.

Recommended Post: What Is An LLC? – Should I Start One?

Whether you are a solopreneur or manage one or several LLCs with more than one partner, understanding your options can help you save money and optimize your operations.

In this guide, we’ll break down the five different ways your LLC can file taxes, making it easier for you to decide which path to take.

· Considerations ·

Before going any further we wanted to simplify everything so it is the easiest way for you to understand and choose your options, an later on depending on what you choose we will explain what you need to do.

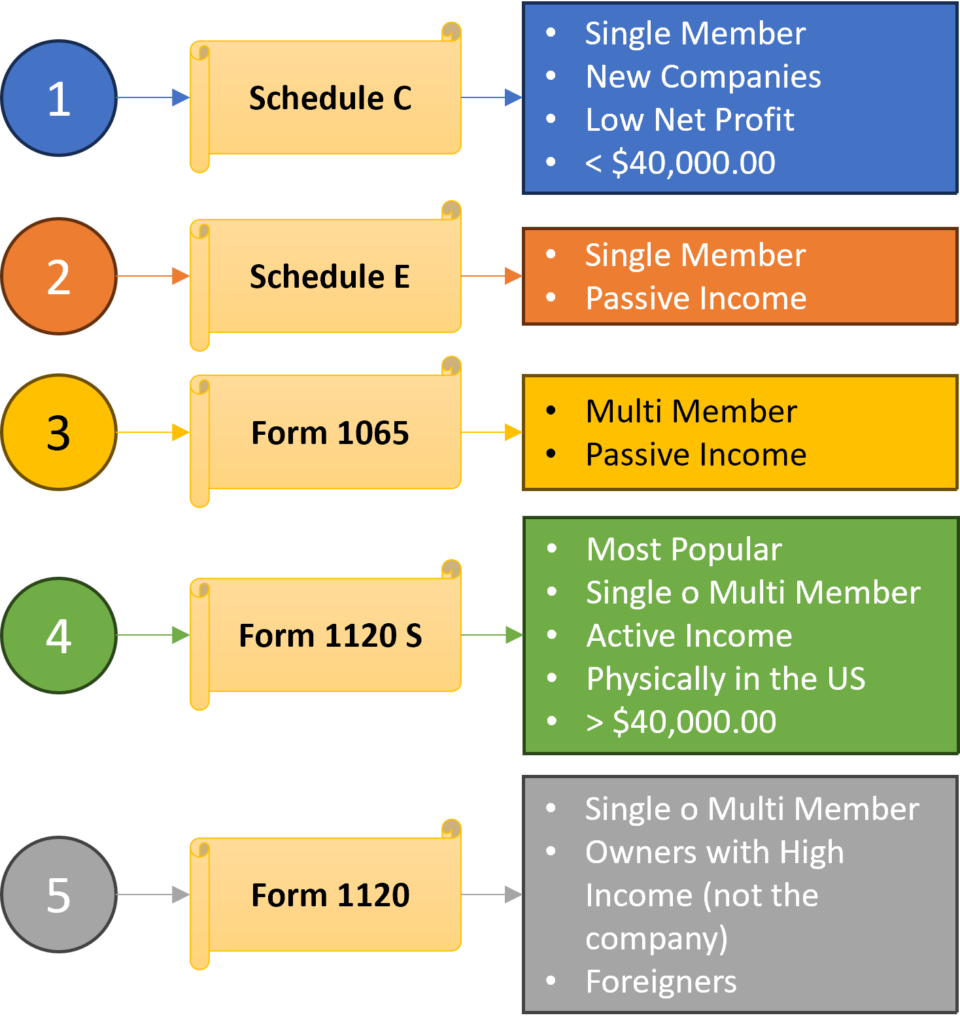

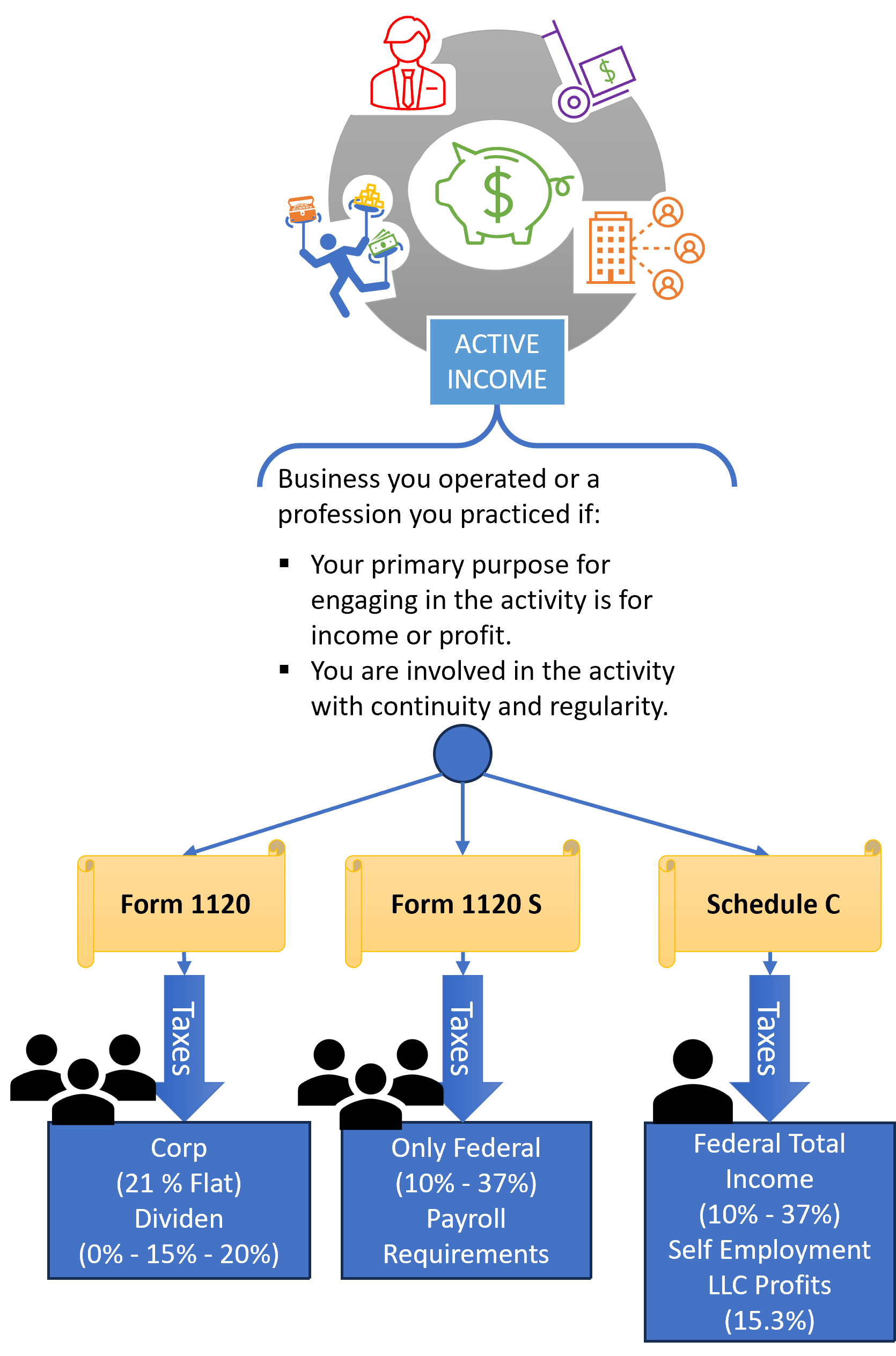

- Even though there are 5 ways to literally present your taxes as you can see in the draw below, we are going to expose you a different approach to them where you may find that in practice there are really 3 ways, but in the formality there are 5 different filling Forms/Schedules that you will need.

- When choosing your way, the reality is that it makes no difference if you are a single or a multi/member LLC.

- Even if someone tell you different you will see this below.

- For filling is different than for choosing.

But don’t worry we will explain everything.

· The Main 3 ways ·

Click the image to enlarge

· Summary ·

So, you have 3 options to declare the taxes of your LLC and all its members will have to agree and pay them according to what is decided from the following 3 options (regardless of whether it is 1 or more members):

- Passthrough: Transfer the taxes to the members, in other words the LLC as such does not pay any taxes, it only reports the profits that correspond to each member and they will have to pay according to their income in the year the Federal Tax that goes from 10% up to 37%; In some cases, if the member actively works in the LLC, he will have to pay the Self Employment Tax of 15.3% on the total of what he has received from the LLC in which he works.

- Declare as an S-Corp: This is one of the most popular options since, like option 1, the LLC does not pay any taxes and only reports the profits that correspond to each member, who will have to pay accordingly to their income during the year the Federal Tax that goes from 10% to 37%; In this case, if any member actively works in the LLC, they will not have to pay the 15.3% Self Employment Tax, but there is only one condition, which is that any member who actively works in the LLC is registered in the payroll with a reasonable salary in accordance with the IRS.

- C-Corp, in other words, is the same as being incorporated as a Corporation instead of an LLC with the advantage that you can change it if you want. In this case the LLC pays its own taxes at a current rate of 21% and has the possibility of deducting many more things than if it declares in any other form. The problem is when the money is to be withdrawn from the LLC, the profits that have already paid 21% are subject to each member paying a tax on the dividends that are distributed, which can result in double income taxes. This option also involves in most cases having an accountant keep the accounts and file the taxes for the LLC as a corporation. But in some cases it can be convenient. Below we will discuss this further.

· Weren't there 5? ·

In practice, there are 5 different forms that you can fill out when you go to file your taxes.

- Schedule C – It is for LLC with only 1 member who actively works the LLC. The LLC does not pay its own taxes, it passes them on to the member and he declares the federal tax and the self employment tax.

- Schedule E – It is the same as Schedule C but in this case it is when the member does not actively work, that is, a passive income for which he only pays the Federal Tax but not the Self employment Tax.

- Form 1065 – This form is when there is more than 1 member in the LLC, the company fill its income and distribution report and gives each member what they are entitled to and they will have to pay their taxes depending on whether it is passive income or active income as in the previous options. This option is a set of options 1 and 2 but is used when there is more than 1 member.

The 3 forms that we mentioned above are handled as 1 option, in the end it is to transfer the income of the LLC to each member and they pay the federal tax and if they actively work in the LLC they will pay the self employment tax as well.

- Form 1120S – This is the well-known S-Corp, where the members who actively work in the company must receive a reasonable salary and the income of the company is distributed among the members, there may be one or many and each one pays their own federal Tax.

- Form 1120 – This is the C-Corp option. Company taxes are handled the same as in a corporation.

· Active vs. Passive ·

Click the image to enlarge

· How to choose? ·

In general and in most cases we recommend that you follow the following recommendation:

Anyway, before choosing it is good to talk to an accountant about this point. The advice will not cost you much and in your particular case it may be that a way that you had not considered would suit you, although according to these tables it is not the most convenient. For example:

If you are a foreigner or a group of foreigners and none of you live in the US and the LLC you have provides a service and does not sell products. Whether consulting, marketing, etc. but they do not have a physical store and none of their members physically live in the US, then, no matter how much the LLC generates, Schedule C or 1065 (passthrough) is best for you, since by not living in the US you do not have to pay social security or self employment tax nor federal tax because the income will be sent to your country and there you will pay your country’s tax. In other words you pay “0” in the US in this case.

As you saw, in very specific cases another option may be better than the one you had contemplated.

· Conclusion ·

The flexibility of the LLC structure allows business owners to choose the tax filing method that best suits their needs. Each option has its own advantages and considerations. By carefully evaluating your specific circumstances and seeking professional guidance, you can navigate the LLC tax landscape with confidence and ensure your business is positioned for long-term success.

Braceability

Braceability

Yoga Download

Yoga Download

ShipBob:

ShipBob:

Sihoo

Sihoo